IRS Refund Dates 2025: A Complete Information To Understanding Your Tax Return Timeline

IRS Refund Dates 2025: A Complete Information to Understanding Your Tax Return Timeline

Associated Articles: IRS Refund Dates 2025: A Complete Information to Understanding Your Tax Return Timeline

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to IRS Refund Dates 2025: A Complete Information to Understanding Your Tax Return Timeline. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

IRS Refund Dates 2025: A Complete Information to Understanding Your Tax Return Timeline

The anticipation of a tax refund is a typical feeling for a lot of People. Realizing when to anticipate that refund can considerably influence monetary planning. Whereas the IRS does not publish a exact, day-by-day calendar of refund issuance for the complete yr, understanding the components that affect refund timing permits for a extra correct prediction for the 2025 tax yr. This text supplies a complete information to navigating the IRS refund course of for 2025, providing insights into potential timelines and methods for maximizing refund velocity.

Understanding the IRS Refund Course of:

Earlier than diving into potential 2025 dates, it is essential to grasp the IRS’s refund course of. The journey begins with submitting your tax return. This may be carried out electronically by tax preparation software program, a tax skilled, or instantly by the IRS web site. E-filing is considerably sooner than paper submitting, because it eliminates guide knowledge entry and processing delays.

As soon as the IRS receives your return, it undergoes a collection of checks and validations. This consists of verifying your identification, checking for mathematical errors, and guaranteeing the data offered aligns with different IRS data. If every thing is so as, your return is processed, and the refund is permitted.

The tactic of receiving your refund additionally impacts the timing. Direct deposit is the quickest technique, usually leading to refunds hitting financial institution accounts inside 21 days of the IRS receiving and approving the return. Paper checks, alternatively, take significantly longer, usually taking a number of weeks longer than direct deposit.

Components Influencing 2025 Refund Dates:

A number of components past the IRS’s processing velocity affect while you obtain your 2025 refund:

-

Submitting Date: The sooner you file, the earlier you’ll be able to probably obtain your refund. That is very true for those who file electronically and select direct deposit. Those that file early within the tax season, usually January or February, usually obtain their refunds earlier than those that file nearer to the April fifteenth deadline.

-

Submitting Methodology: As talked about, digital submitting (e-filing) is considerably sooner than paper submitting. E-filing permits for instant transmission of your knowledge to the IRS, decreasing processing time significantly.

-

Refund Quantity: Whereas not a direct correlation, exceptionally giant or complicated refunds may take barely longer to course of as a result of elevated scrutiny.

-

Errors and Changes: Errors in your tax return, whether or not easy mathematical errors or extra complicated points requiring additional investigation, can considerably delay your refund. Equally, if the IRS must make changes to your return, this may add time to the method.

-

IRS Processing Instances: The IRS’s processing capability and effectivity can differ from yr to yr. Components reminiscent of finances constraints, staffing ranges, and technological upgrades can influence processing instances. Whereas the IRS goals for constant processing, unexpected circumstances may cause non permanent delays.

-

Identification Verification: The IRS employs stringent identification verification measures to forestall fraud. In case your return triggers further identification verification procedures, this could add a number of weeks to the processing time.

Predicting 2025 Refund Dates: A Reasonable Method:

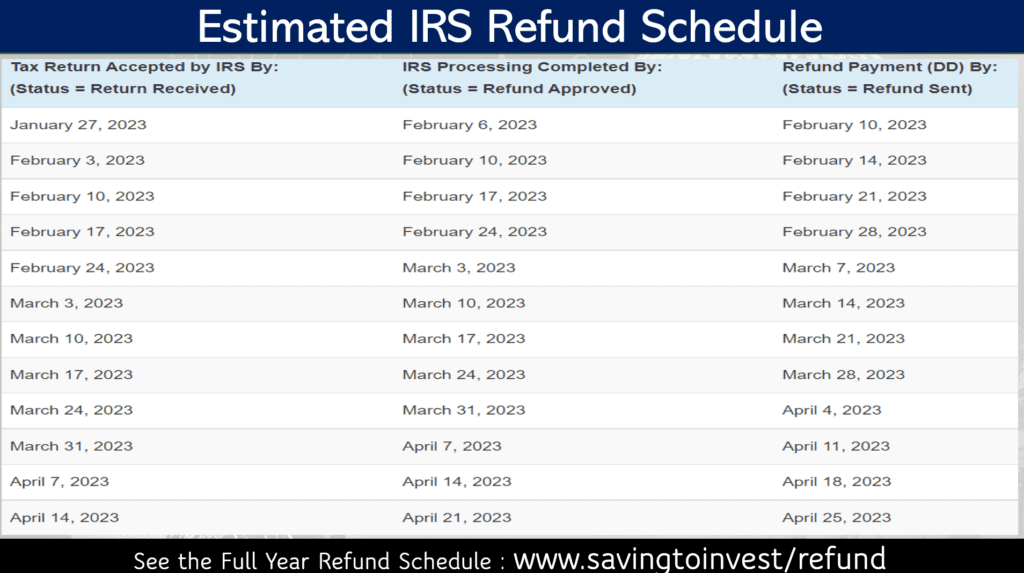

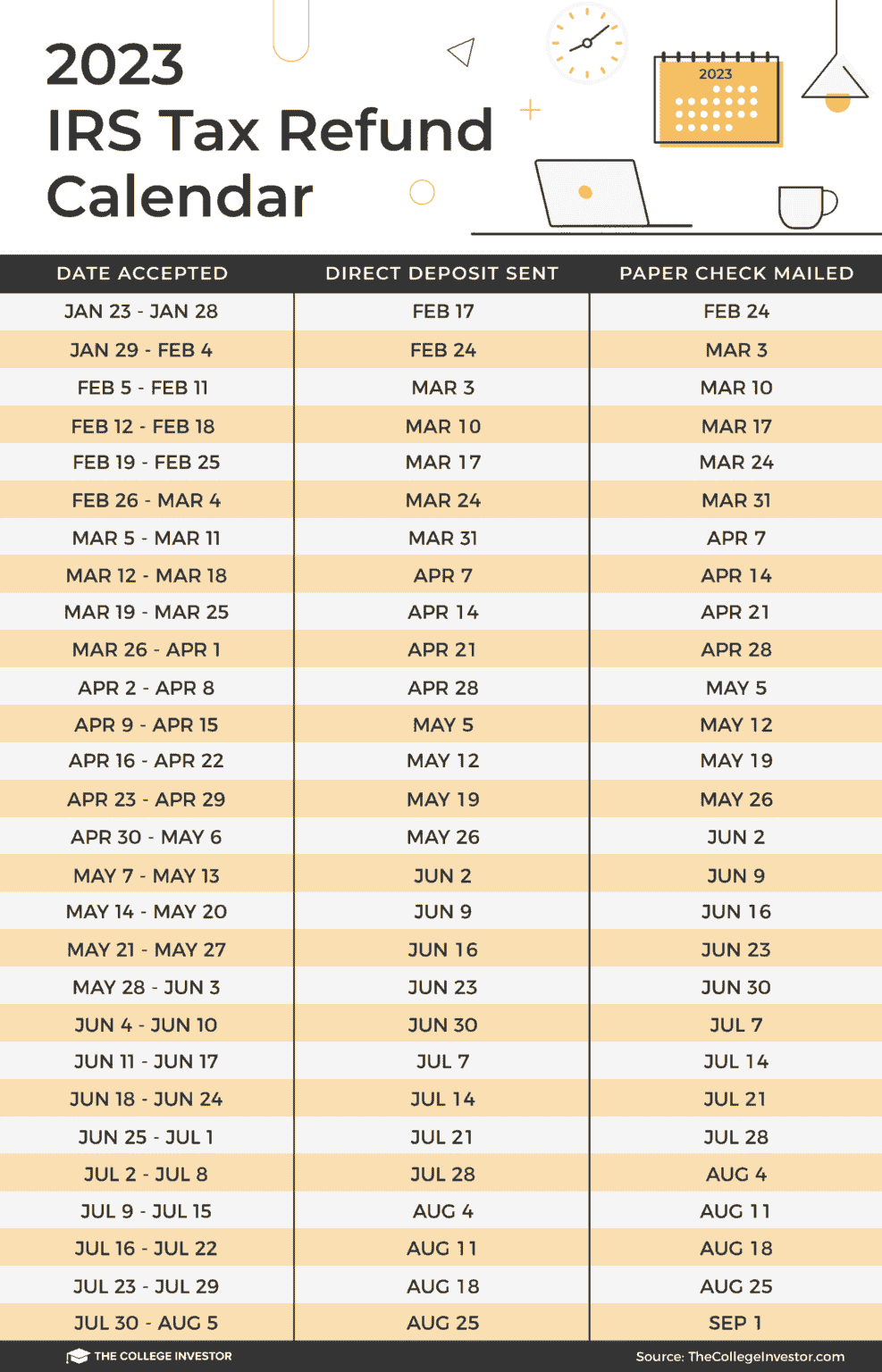

Whereas a exact calendar for 2025 refund dates is unavailable, we will make some educated estimations based mostly on previous traits. Assuming the IRS maintains related processing speeds as lately, and barring any unexpected circumstances, we will anticipate the next:

-

Early Filers (January/February): These taxpayers can anticipate their refunds inside 2-3 weeks of e-filing with direct deposit. Paper checks might take 4-6 weeks or longer.

-

Mid-Season Filers (March/April): Refunds for these submitting throughout this era may take 3-4 weeks with direct deposit and 5-7 weeks or extra with paper checks. Delays are extra probably because the IRS processes a better quantity of returns.

-

Late Filers (Near April fifteenth): These taxpayers ought to anticipate the longest wait instances, probably 4-6 weeks for direct deposit and eight weeks or extra for paper checks.

Methods to Maximize Refund Pace in 2025:

-

File Electronically: E-filing is the simplest technique to velocity up the refund course of.

-

Select Direct Deposit: Direct deposit is considerably sooner than receiving a paper verify.

-

Double-Test Your Return: Rigorously evaluate your tax return earlier than submitting it to reduce errors and potential delays.

-

Use Tax Preparation Software program or a Skilled: Tax software program may help catch errors and guarantee accuracy. A tax skilled can supply professional steering and assist navigate complicated tax conditions.

-

Observe Your Refund: Use the IRS’s on-line device, "The place’s My Refund?", to observe the standing of your return.

The Significance of Planning:

Understanding the potential timeline to your 2025 tax refund is essential for efficient monetary planning. Realizing when to anticipate your refund permits you to finances accordingly, repay money owed, or make different essential monetary selections. By taking proactive steps to file early, precisely, and electronically, you’ll be able to considerably improve the chance of receiving your refund shortly and effectively.

Conclusion:

Whereas a particular 2025 IRS refund calendar stays elusive, understanding the components influencing refund timing and using strategic planning may help you navigate the method successfully. By submitting early, selecting digital submitting and direct deposit, and meticulously reviewing your return, you’ll be able to maximize your possibilities of receiving your refund promptly. Keep in mind to make the most of the IRS’s on-line instruments to trace your refund’s progress and keep knowledgeable all through the method. By being proactive and knowledgeable, you’ll be able to rework the anticipation of your tax refund right into a constructive and well timed monetary occasion.

Closure

Thus, we hope this text has offered beneficial insights into IRS Refund Dates 2025: A Complete Information to Understanding Your Tax Return Timeline. We thanks for taking the time to learn this text. See you in our subsequent article!