Lowe’s Fiscal 12 months 2025: Navigating The Shifting Sands Of The House Enchancment Panorama

Lowe’s Fiscal 12 months 2025: Navigating the Shifting Sands of the House Enchancment Panorama

Associated Articles: Lowe’s Fiscal 12 months 2025: Navigating the Shifting Sands of the House Enchancment Panorama

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Lowe’s Fiscal 12 months 2025: Navigating the Shifting Sands of the House Enchancment Panorama. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Lowe’s Fiscal 12 months 2025: Navigating the Shifting Sands of the House Enchancment Panorama

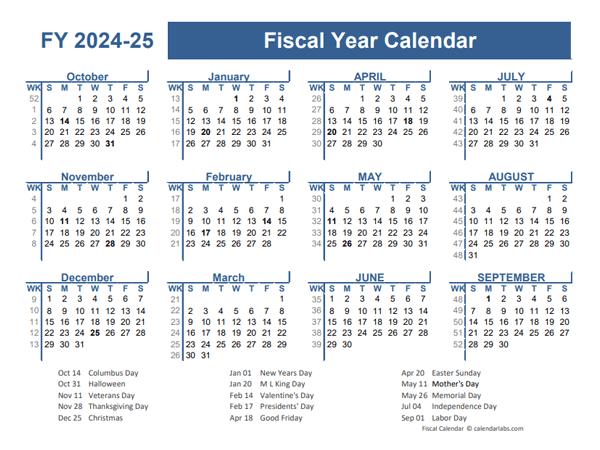

Lowe’s Firms, Inc., a house enchancment big, operates on a fiscal 12 months (FY) that runs from February 1st to January thirty first. Subsequently, Lowe’s FY2025 encompasses the interval from February 1, 2024, to January 31, 2025. This era guarantees to be a pivotal one for the corporate, demanding strategic navigation by way of a fancy and evolving financial and client panorama. Analyzing the potential challenges and alternatives inside this fiscal 12 months requires a multifaceted method, contemplating macroeconomic traits, aggressive pressures, and Lowe’s inner methods.

Macroeconomic Elements Shaping FY2025:

The overarching macroeconomic surroundings will considerably affect Lowe’s efficiency in FY2025. A number of key elements warrant shut consideration:

-

Inflation and Curiosity Charges: Persistently excessive inflation and elevated rates of interest proceed to affect client spending. The housing market, a key driver of Lowe’s gross sales, stays delicate to rate of interest fluctuations. Larger borrowing prices can dampen demand for brand spanking new residence development and renovations, instantly affecting Lowe’s gross sales of constructing supplies and home equipment. The corporate’s potential to handle its personal prices amidst inflationary pressures will likely be essential to sustaining profitability.

-

Client Confidence and Spending: Client sentiment performs an important position in figuring out discretionary spending on residence enchancment initiatives. Elements like job safety, wage development, and general financial outlook affect shoppers’ willingness to put money into residence renovations or new home equipment. A decline in client confidence might result in a discount in discretionary spending, impacting Lowe’s gross sales quantity.

-

Provide Chain Dynamics: Whereas provide chain disruptions have eased considerably, potential geopolitical instability and unexpected occasions might nonetheless create bottlenecks and have an effect on the supply of key merchandise. Lowe’s potential to take care of a sturdy and resilient provide chain will likely be essential to assembly client demand and avoiding stockouts.

-

Housing Market Situations: The housing market is a bellwether for Lowe’s efficiency. Elements like residence costs, mortgage charges, and stock ranges all affect the demand for residence enchancment merchandise. A slowdown within the housing market might translate into decrease gross sales for Lowe’s, notably in areas closely reliant on new development.

Aggressive Panorama and Strategic Responses:

Lowe’s operates in a extremely aggressive market, going through challenges from each giant nationwide chains like House Depot and smaller regional gamers. To achieve FY2025, Lowe’s should successfully handle a number of aggressive pressures:

-

House Depot’s Dominance: House Depot stays Lowe’s major competitor, possessing a bigger market share and a robust model fame. Lowe’s must differentiate itself by way of strategic initiatives, similar to enhancing its customer support, bettering its on-line presence, and providing distinctive product assortments.

-

E-commerce Competitors: On-line retailers are more and more encroaching on the house enchancment market. Lowe’s must proceed investing in its e-commerce platform, guaranteeing seamless on-line procuring experiences, handy supply choices, and aggressive pricing.

-

Specialty Retailers: Specialty retailers specializing in area of interest segments of the house enchancment market pose a risk. Lowe’s must adapt its technique to cater to particular buyer wants and preferences, maybe by way of focused advertising and marketing campaigns and specialised product choices.

Lowe’s Strategic Initiatives for FY2025:

To navigate the challenges and capitalize on alternatives in FY2025, Lowe’s is more likely to concentrate on a number of key strategic initiatives:

-

Enhancing the Buyer Expertise: Bettering in-store and on-line customer support, providing customized suggestions, and offering seamless omnichannel experiences are essential for attracting and retaining prospects.

-

Investing in Expertise: Continued funding in know-how, together with its e-commerce platform, stock administration methods, and information analytics capabilities, will enhance operational effectivity and improve the shopper expertise.

-

Provide Chain Optimization: Strengthening its provide chain resilience by diversifying sourcing, bettering logistics, and constructing stronger relationships with suppliers will assist mitigate potential disruptions.

-

Strategic Pricing and Promotions: Balancing aggressive pricing with profitability will likely be important. Strategic promotions and focused reductions can entice price-sensitive prospects whereas sustaining margins.

-

Give attention to Professional Clients: The skilled contractor market represents a major income stream for Lowe’s. Specializing in this section by way of specialised providers, product choices, and loyalty applications can drive gross sales development.

-

Sustainable Practices: More and more environmentally aware shoppers are driving demand for sustainable merchandise and practices. Lowe’s can leverage this pattern by increasing its vary of eco-friendly merchandise and selling sustainable initiatives.

Potential Challenges and Dangers:

Regardless of Lowe’s strategic initiatives, a number of challenges and dangers might affect its efficiency in FY2025:

-

Financial Downturn: A big financial downturn might severely affect client spending on residence enchancment initiatives, resulting in decrease gross sales and decreased profitability.

-

Geopolitical Uncertainty: International geopolitical occasions might disrupt provide chains, improve enter prices, and negatively affect client confidence.

-

Elevated Competitors: Intensified competitors from each conventional and on-line retailers might erode Lowe’s market share and strain margins.

-

Labor Shortages: Discovering and retaining expert labor stays a problem throughout the retail business. Labor shortages might affect operational effectivity and customer support.

Conclusion:

Lowe’s FY2025 presents each alternatives and challenges. The corporate’s success will rely on its potential to successfully navigate the complicated macroeconomic surroundings, handle aggressive pressures, and execute its strategic initiatives. Sustaining a robust concentrate on buyer expertise, optimizing its provide chain, and leveraging know-how will likely be essential for attaining its monetary targets. Shut monitoring of client sentiment, inflation charges, and housing market situations will likely be important for adapting its methods and mitigating potential dangers. The approaching 12 months will likely be a check of Lowe’s resilience and flexibility in a dynamic and ever-changing market. Finally, the corporate’s efficiency will likely be a mirrored image of its capability to anticipate market shifts, innovate successfully, and preserve its place as a number one participant within the residence enchancment sector.

Closure

Thus, we hope this text has supplied priceless insights into Lowe’s Fiscal 12 months 2025: Navigating the Shifting Sands of the House Enchancment Panorama. We recognize your consideration to our article. See you in our subsequent article!