Mastering The Bi-Weekly Pay Interval: A Complete Information To Calendars, Calculations, And Greatest Practices

Mastering the Bi-Weekly Pay Interval: A Complete Information to Calendars, Calculations, and Greatest Practices

Associated Articles: Mastering the Bi-Weekly Pay Interval: A Complete Information to Calendars, Calculations, and Greatest Practices

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering the Bi-Weekly Pay Interval: A Complete Information to Calendars, Calculations, and Greatest Practices. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Mastering the Bi-Weekly Pay Interval: A Complete Information to Calendars, Calculations, and Greatest Practices

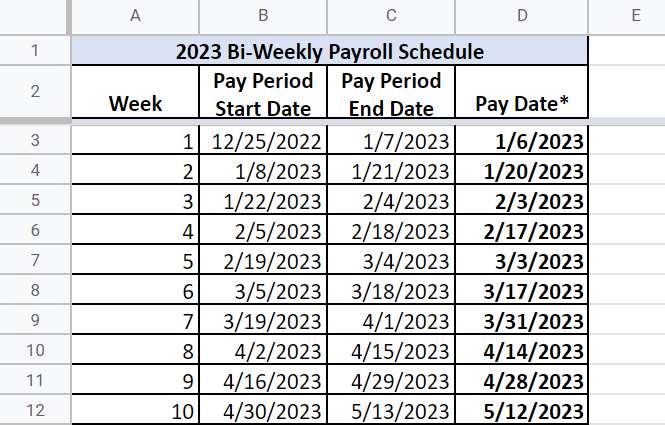

The bi-weekly pay interval, occurring each two weeks, is a standard payroll follow throughout many industries. Understanding this method is essential for each employers and workers, guaranteeing correct payroll processing, well timed funds, and clear monetary planning. This text delves into the intricacies of the bi-weekly pay interval, offering an in depth clarification of calendar creation, pay date calculations, potential issues, and greatest practices for managing this method successfully.

Understanding the Bi-Weekly Pay Interval:

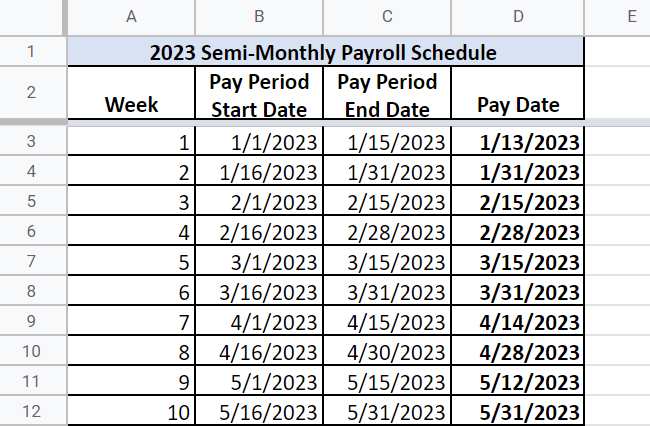

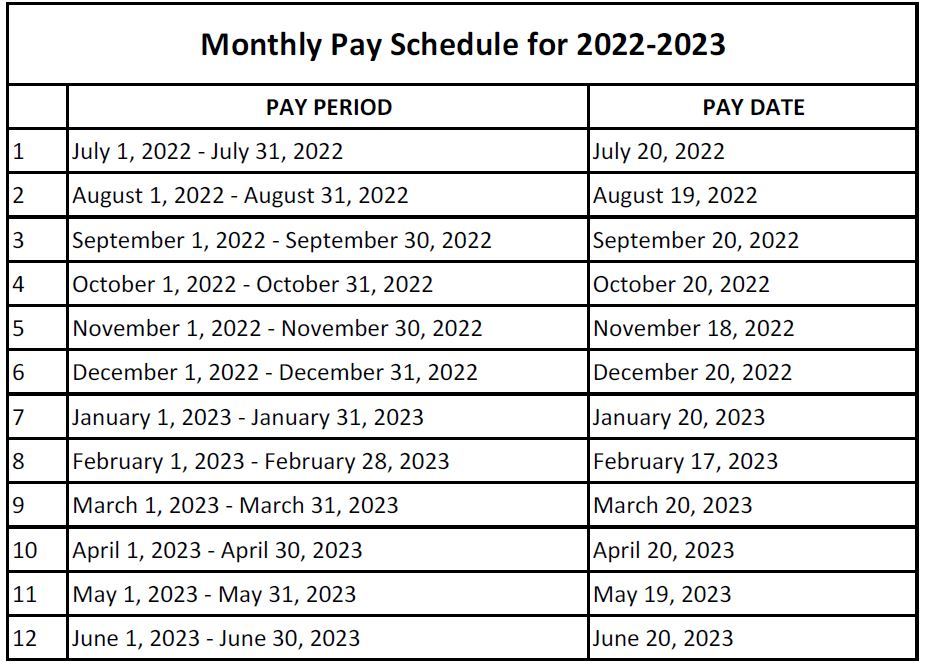

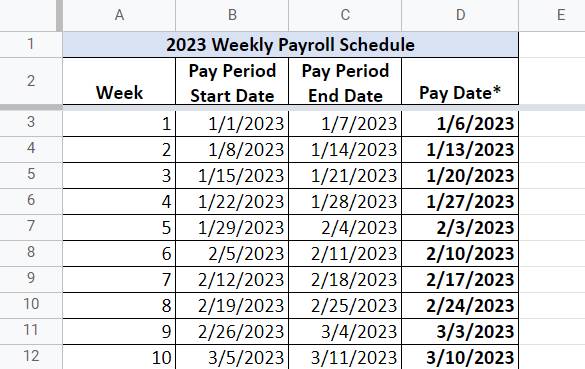

Not like a semi-monthly pay interval (twice a month), a bi-weekly pay interval at all times consists of precisely two weeks, whatever the variety of days in a month. Which means that pay intervals can generally have 14 days and generally 15 days, relying on whether or not the interval crosses a month boundary. This variation can result in some confusion if not correctly understood and managed. The constant two-week interval, nevertheless, affords a predictable cost schedule for workers.

Making a Bi-Weekly Pay Interval Calendar:

Creating an correct bi-weekly pay interval calendar is paramount. Whereas seemingly easy, inconsistencies can come up if not approached systematically. Here is a step-by-step information:

-

Decide the Begin Date: Step one includes choosing a beginning date in your first pay interval. This date serves as the inspiration for all subsequent pay intervals. Take into account components like the corporate’s fiscal yr or a handy date for payroll processing.

-

Set up the Pay Frequency: Verify that the pay interval is certainly bi-weekly, that means each two weeks. This ensures consistency all through the calendar.

-

Calculate Subsequent Pay Dates: Including 14 days to the preliminary pay date will decide the next pay dates. This course of is repeated for your complete yr or desired timeframe.

-

Account for Leap Years: Leap years introduce an extra day, requiring changes to the calendar. The extra day must be included into the calculations, guaranteeing that the pay interval stays exactly two weeks.

-

Make the most of Spreadsheet Software program: Software program like Microsoft Excel or Google Sheets is invaluable for creating and managing a bi-weekly pay interval calendar. Formulation can automate the calculation of pay dates, decreasing the chance of errors and saving time.

Instance Bi-Weekly Pay Interval Calendar (2024):

Let’s assume the primary pay interval begins on January 1, 2024. Utilizing a spreadsheet, we are able to simply generate the next calendar:

| Pay Interval | Begin Date | Finish Date | Pay Date | Days in Interval |

|---|---|---|---|---|

| 1 | January 1, 2024 | January 14, 2024 | January 15, 2024 | 14 |

| 2 | January 15, 2024 | January 28, 2024 | January 29, 2024 | 14 |

| 3 | January 29, 2024 | February 11, 2024 | February 12, 2024 | 14 |

| 4 | February 12, 2024 | February 25, 2024 | February 26, 2024 | 14 |

| 5 | February 26, 2024 | March 11, 2024 | March 12, 2024 | 14 |

| … | … | … | … | … |

(Notice: This can be a partial instance and needs to be prolonged for your complete yr. The pay date is often one or two days after the top date to permit for processing.)

Calculating Wages and Deductions:

Correct wage calculation is essential. With a bi-weekly pay interval, the worker’s annual wage is split by 26 (the variety of bi-weekly intervals in a yr). This leads to the gross pay for every pay interval. Deductions, similar to taxes, insurance coverage premiums, and retirement contributions, are then subtracted to find out the online pay.

Addressing Potential Issues:

A number of components can complicate a bi-weekly pay interval:

-

Various Variety of Days: The fluctuating variety of days (14 or 15) in every pay interval can have an effect on calculations involving every day charges or time beyond regulation pay. Cautious consideration to element is critical to make sure correct compensation.

-

Holidays and Sick Go away: Holidays falling inside a pay interval require changes to pay calculations. Equally, sick go away or trip time taken must be accounted for precisely.

-

12 months-Finish Changes: On the finish of the yr, discrepancies may come up as a result of various variety of days in pay intervals. Cautious reconciliation is critical to make sure correct year-end reporting and tax filings.

-

Payroll Software program Integration: Correct integration with payroll software program is essential for correct and environment friendly processing. The software program needs to be configured to deal with the specifics of a bi-weekly pay interval precisely.

Greatest Practices for Managing Bi-Weekly Pay Durations:

-

Use Automated Techniques: Leveraging payroll software program and automatic methods minimizes errors and saves time.

-

Common Audits: Conduct common audits of payroll knowledge to establish and proper any discrepancies.

-

Clear Communication: Preserve clear communication with workers concerning pay dates, pay stubs, and any changes to their pay.

-

Worker Self-Service Portals: Present workers with entry to on-line portals the place they’ll view their pay stubs, tax data, and different related payroll knowledge.

-

Complete Documentation: Preserve detailed information of all payroll transactions, together with pay intervals, wages, deductions, and any changes made.

-

Skilled Payroll Companies: Take into account outsourcing payroll to an expert payroll service supplier, particularly for bigger organizations, to make sure accuracy and compliance with labor legal guidelines.

Conclusion:

The bi-weekly pay interval, whereas seemingly easy, requires cautious planning and administration. By understanding the nuances of calendar creation, wage calculations, and potential issues, employers can guarantee correct and well timed payroll processing, fostering optimistic worker relations and minimizing monetary dangers. Using acceptable software program, implementing greatest practices, and sustaining clear communication are key to efficiently managing a bi-weekly pay interval system. Common audits and a proactive strategy to potential challenges will contribute to a easy and environment friendly payroll course of.

Closure

Thus, we hope this text has offered beneficial insights into Mastering the Bi-Weekly Pay Interval: A Complete Information to Calendars, Calculations, and Greatest Practices. We respect your consideration to our article. See you in our subsequent article!