Navigating The 2025 New Jersey State Payroll Calendar: A Complete Information For Workers And Employers

Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information for Workers and Employers

Associated Articles: Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information for Workers and Employers

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information for Workers and Employers. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information for Workers and Employers

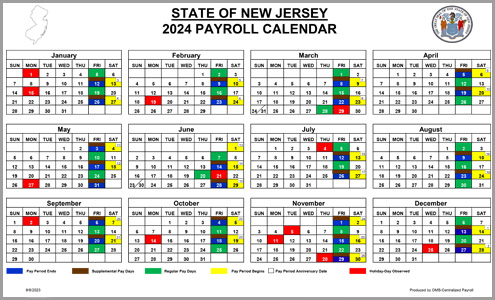

The New Jersey state payroll calendar for 2025 is an important doc for each state workers and employers who course of payroll for his or her workers within the Backyard State. Understanding its intricacies ensures well timed fee, correct tax withholdings, and compliance with state laws. This complete information delves into the important thing points of the 2025 calendar, offering insights for efficient payroll administration. Whereas the exact dates for 2025 should not but formally launched by the state, this text will define the standard construction, components influencing payroll dates, and essential issues for navigating the upcoming yr.

Understanding the Construction of the New Jersey State Payroll Calendar

The New Jersey state payroll calendar, in contrast to a easy record of paydays, is a fancy system influenced by a number of components:

-

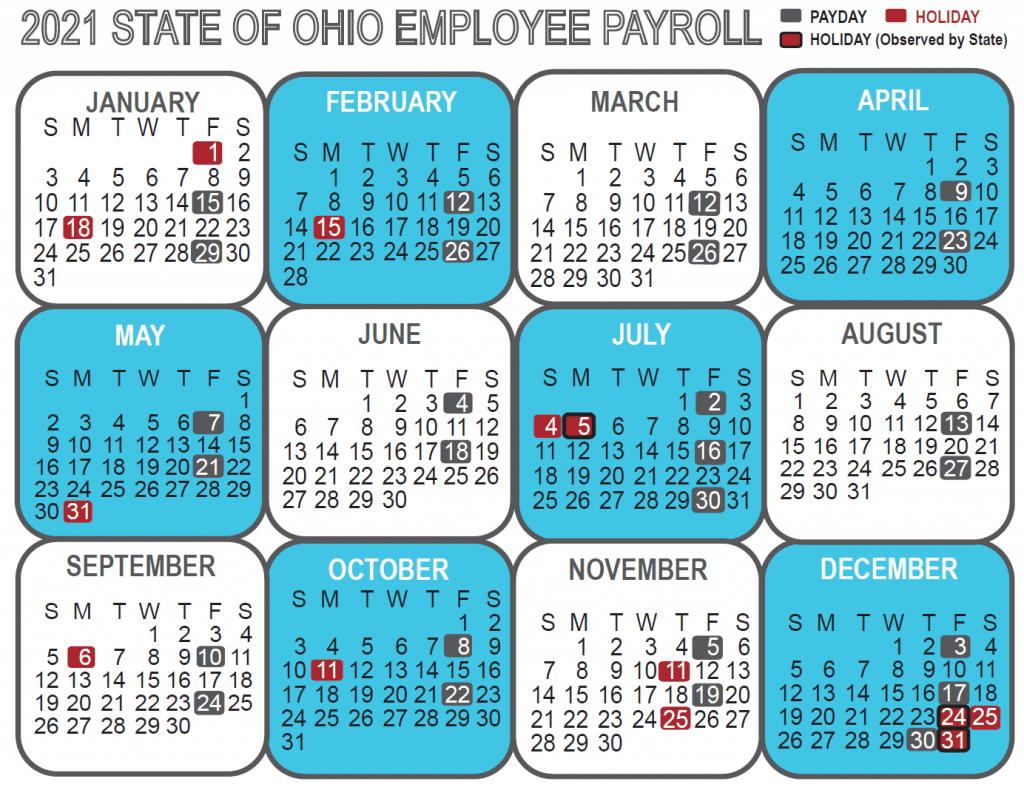

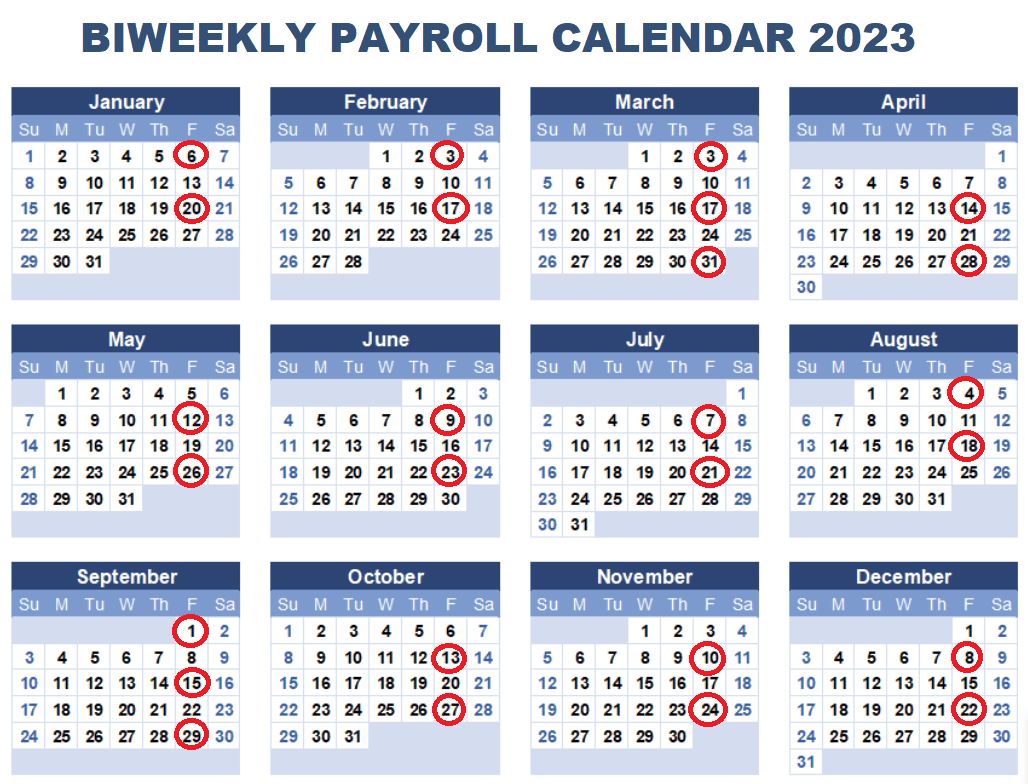

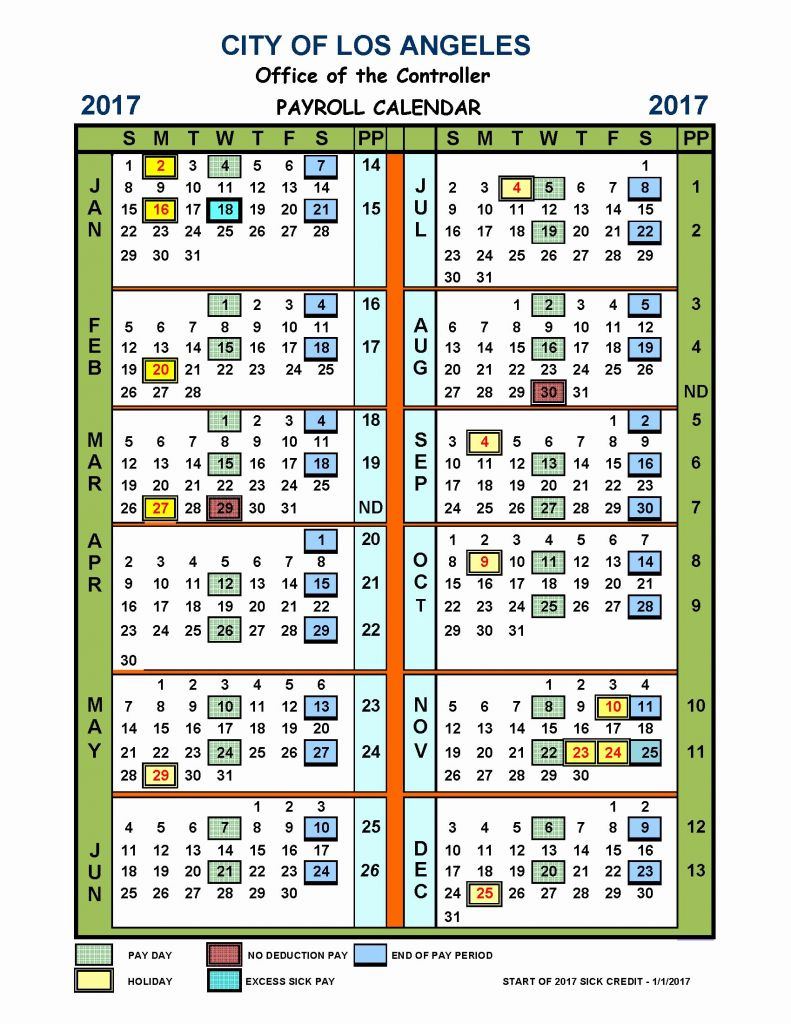

Pay Durations: The state sometimes operates on bi-weekly or semi-monthly pay intervals. Bi-weekly pay intervals imply workers obtain paychecks each two weeks, whereas semi-monthly pay intervals imply they obtain paychecks twice a month, normally on the fifteenth and the final day of the month. The precise schedule is decided by the state’s Division of Treasury and will differ relying on the precise company or division.

-

Holidays: State holidays considerably influence the payroll calendar. When a payday falls on a weekend or vacation, the fee is usually shifted to the previous Friday. The New Jersey state vacation schedule for 2025 will have to be consulted to precisely predict these shifts. This schedule normally contains New Yr’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Juneteenth Nationwide Independence Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day.

-

Yr-Finish Processing: The top of the yr requires cautious planning for payroll. This contains processing year-end tax types like W-2s, making certain correct reporting of annual earnings, and addressing any excellent payroll points. The calendar will mirror changes wanted for this significant interval.

-

Potential Variations: It is vital to notice that the payroll calendar may not be uniform throughout all state businesses. Sure departments or businesses could have barely totally different schedules attributable to inside administrative procedures. Workers ought to all the time confer with their particular company’s payroll tips for essentially the most correct data.

Components Influencing the 2025 Payroll Calendar

A number of components past the usual vacation schedule can affect the 2025 New Jersey state payroll calendar:

-

Legislative Adjustments: Any modifications in state legal guidelines relating to payroll taxes or fee schedules will instantly influence the calendar. It is essential for employers and workers to remain up to date on legislative developments.

-

Budgetary Issues: The state’s finances course of can not directly affect payroll schedules, though that is much less frequent. Main budgetary modifications may result in changes in fee timelines.

-

System Upgrades: Technological upgrades to the state’s payroll techniques might quickly have an effect on the discharge of paychecks. Any such upgrades will likely be introduced nicely upfront to reduce disruptions.

-

Unexpected Circumstances: Occasions like pure disasters or different unexpected circumstances might necessitate changes to the payroll calendar. The state will talk any such modifications by way of official channels.

Accessing the Official 2025 Calendar

The official 2025 New Jersey state payroll calendar will likely be launched by the New Jersey Division of the Treasury nearer to the start of the yr. One of the simplest ways to entry this significant doc is thru the next:

-

The Division of Treasury Web site: The official web site would be the main supply for the up to date calendar. Search for bulletins and publications associated to payroll and worker compensation.

-

Company-Particular Intranets: State workers ought to test their company’s inside web site or intranet for payroll data particular to their division.

-

Payroll Departments: Straight contacting the payroll division of the related state company is one other efficient technique to acquire the calendar.

Key Issues for Workers

-

Direct Deposit: Guarantee your direct deposit data is up-to-date to keep away from delays in receiving your paycheck.

-

Tax Withholding: Overview your tax withholding data to make sure it is correct and displays your present tax state of affairs.

-

Payroll Inquiries: Know easy methods to contact your company’s payroll division to handle any questions or issues relating to your paycheck.

-

Pay Stub Overview: Often evaluate your pay stubs to confirm the accuracy of your earnings, deductions, and internet pay.

Key Issues for Employers

-

Compliance: Guarantee full compliance with all New Jersey state payroll tax legal guidelines and laws.

-

Payroll Software program: Make the most of dependable payroll software program to streamline payroll processing and guarantee accuracy.

-

Tax Reporting: Precisely put together and file all mandatory tax stories associated to worker compensation.

-

Report Conserving: Keep meticulous information of all payroll transactions and worker data.

-

Skilled Help: Take into account partaking a payroll specialist or outsourcing payroll processing to make sure compliance and accuracy.

Making ready for the 2025 Payroll Yr

As 2025 approaches, each workers and employers ought to proactively put together for the brand new payroll yr:

-

Overview Earlier Calendars: Analyzing previous calendars can present insights into typical scheduling patterns.

-

Keep Knowledgeable: Often test the New Jersey Division of the Treasury web site and different official sources for updates on the 2025 payroll calendar.

-

Plan Forward: Budgeting and monetary planning ought to incorporate the anticipated payroll schedule.

-

Communication: Keep open communication between employers and workers relating to payroll issues.

Conclusion

The New Jersey state payroll calendar for 2025 is a crucial software for navigating the complexities of state worker compensation. By understanding the components that affect the calendar’s construction and proactively getting ready for the brand new yr, each state workers and employers can guarantee easy and environment friendly payroll processing whereas sustaining compliance with all related laws. Keep in mind to all the time seek the advice of official sources for essentially the most correct and up-to-date data as the discharge date for the 2025 calendar approaches. This text serves as a information, nevertheless it’s very important to depend on official authorities sources for definitive dates and particulars.

Closure

Thus, we hope this text has supplied beneficial insights into Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information for Workers and Employers. We thanks for taking the time to learn this text. See you in our subsequent article!