Navigating The Netspend Calendar For December 2025: A Complete Information

Navigating the Netspend Calendar for December 2025: A Complete Information

Associated Articles: Navigating the Netspend Calendar for December 2025: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Navigating the Netspend Calendar for December 2025: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Navigating the Netspend Calendar for December 2025: A Complete Information

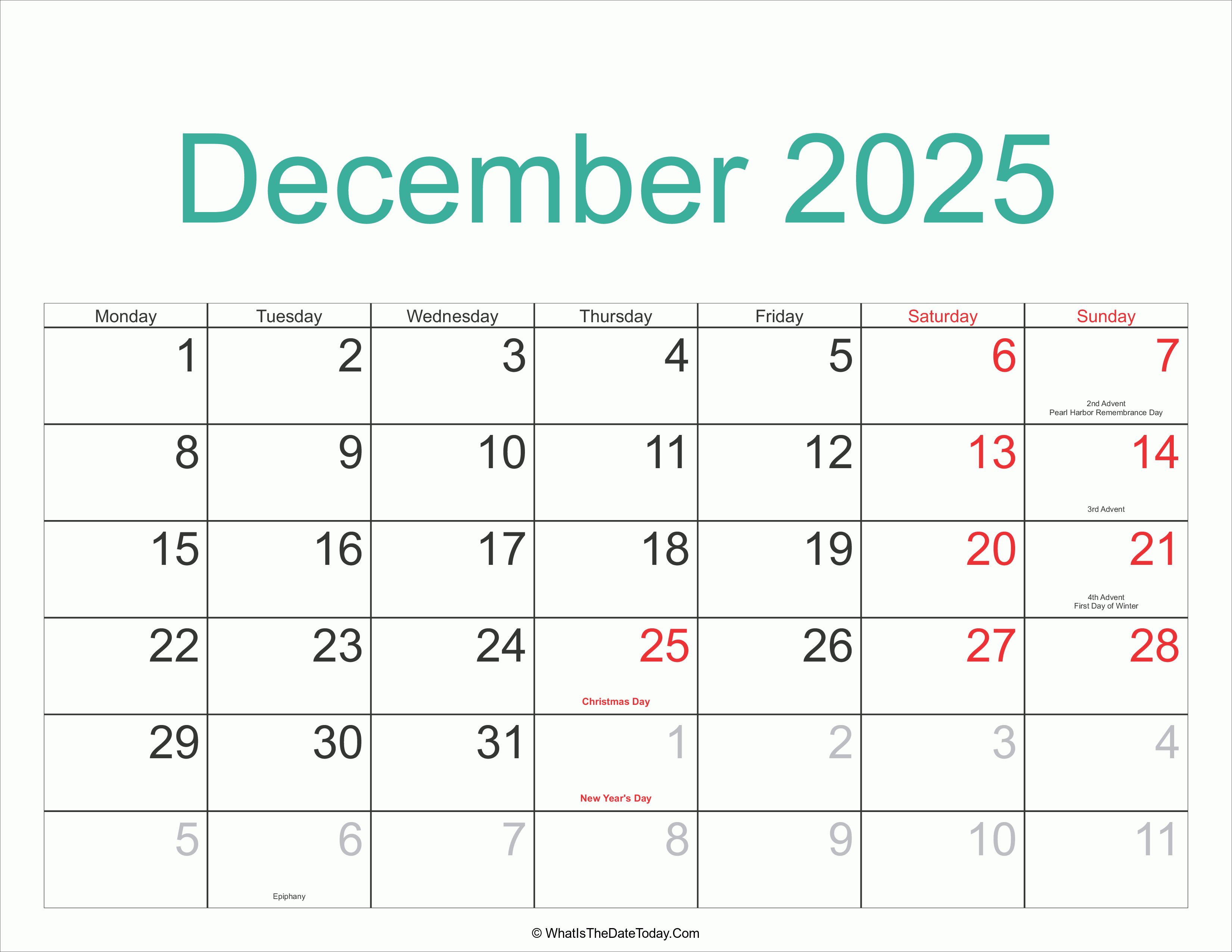

December 2025. The 12 months is winding down, the vacations are approaching, and for a lot of Netspend cardholders, cautious monetary planning is paramount. This text serves as a complete information to navigating your Netspend calendar for December 2025, specializing in key dates, potential challenges, and proactive methods to make sure clean monetary administration all through the festive season. Whereas we can not present particular, future dates from Netspend’s inner calendar (as these are topic to vary and never publicly launched prematurely), we’ll define typical December actions and the way they relate to efficient Netspend utilization.

Understanding Your Netspend Calendar Wants:

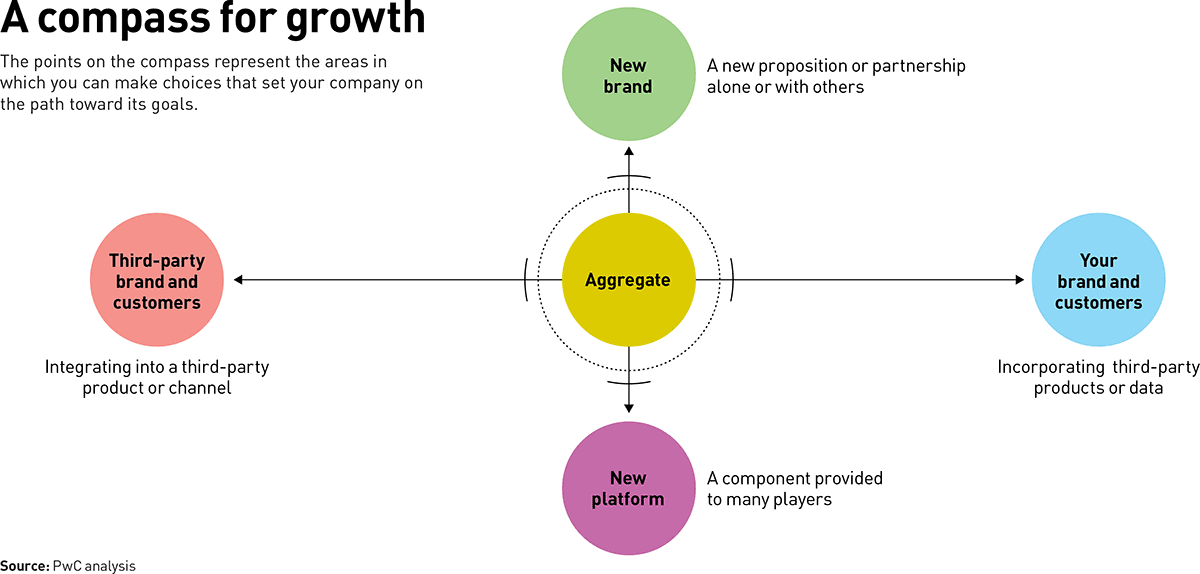

Earlier than diving into the specifics, let’s outline what a "Netspend calendar" means on this context. It is not a bodily calendar supplied by Netspend, however quite a customized schedule primarily based in your anticipated transactions and monetary objectives for December 2025. This encompasses:

- Anticipated earnings: This consists of your common paycheck deposits, any further earnings from vacation jobs or bonuses, and anticipated authorities advantages.

- Scheduled bills: That is the place meticulous planning is essential. Contemplate all anticipated prices: vacation items, journey, meals, leisure, utilities, and common month-to-month payments.

- Essential Netspend-related dates: These are dates associated to potential transaction deadlines, charge evaluation intervals, and any deliberate account changes. Whereas exact dates are unavailable this far prematurely, understanding typical Netspend processes is essential.

- Private monetary objectives: Do you have got particular financial savings targets for the vacations or for the brand new 12 months? Monitoring this towards your projected earnings and bills is important.

Typical December Actions & Their Netspend Implications:

December is usually a month of elevated spending. Let’s break down widespread actions and the way they work together along with your Netspend account:

1. Vacation Procuring:

- Budgeting: Create an in depth vacation buying funds properly prematurely of December. Allocate particular quantities for every recipient and stick with it. Use Netspend’s cellular app to trace your spending in real-time.

- On-line Procuring Safety: Be vigilant about on-line safety when utilizing your Netspend card for on-line purchases. Use safe web sites and keep away from public Wi-Fi for delicate transactions. Monitor your account repeatedly for unauthorized exercise.

- Managing A number of Playing cards: For those who use a number of playing cards for various functions (e.g., one for items, one for journey), clearly label them and observe spending individually inside your Netspend app.

2. Journey & Leisure:

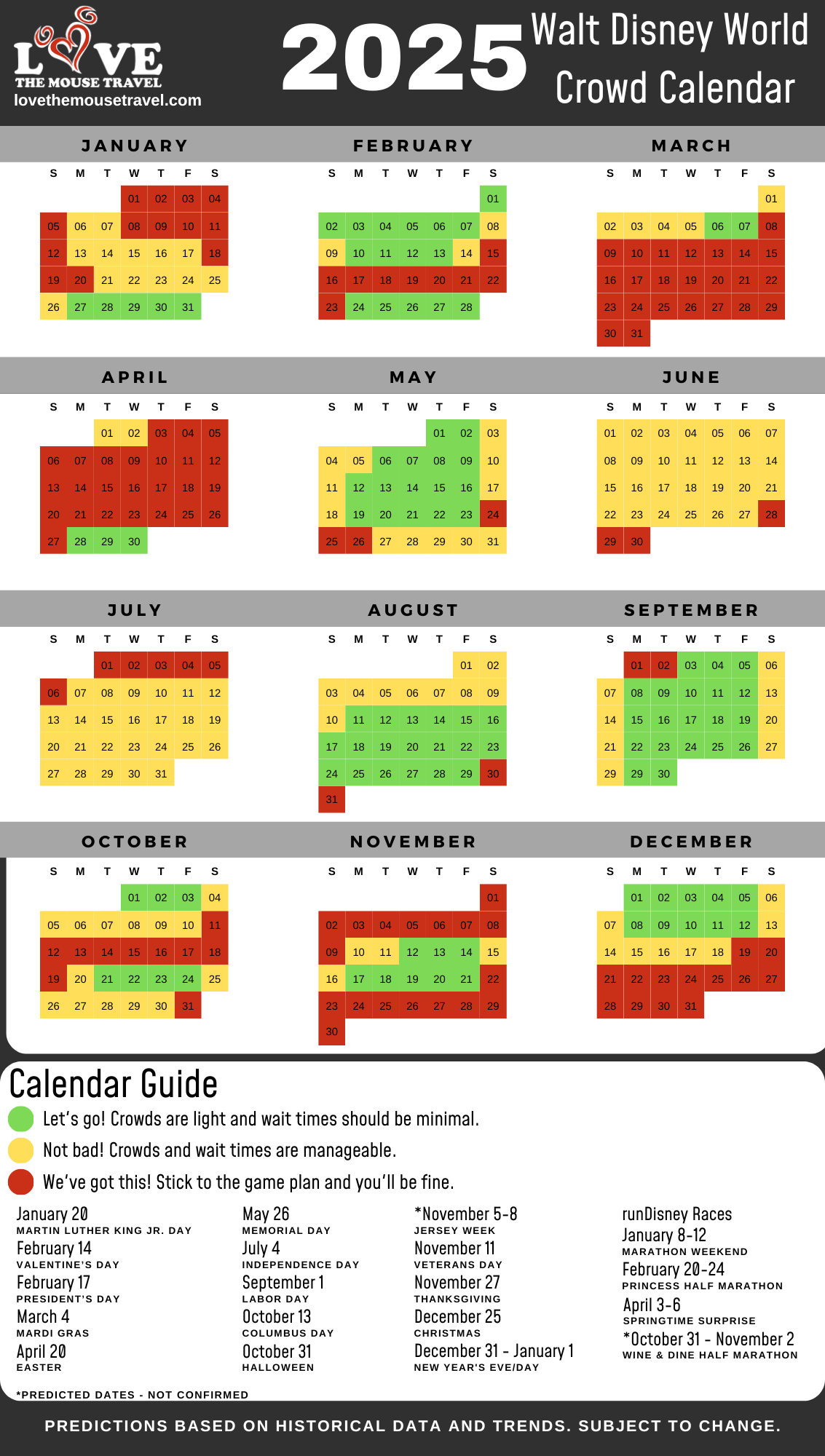

- Pre-booking & Fee: For those who’re touring, ebook flights and lodging properly prematurely to safe higher offers. Use your Netspend card for funds, however guarantee you have got ample funds out there.

- ATM Withdrawals: Plan ATM withdrawals rigorously to keep away from pointless charges. Test the Netspend charge schedule for ATM withdrawal limits and related expenses. Think about using in-network ATMs every time potential to reduce prices.

- Leisure Bills: Set a funds for vacation leisure, together with meals, occasions, and actions. Monitor your spending meticulously utilizing the Netspend app or a budgeting spreadsheet.

3. Invoice Funds:

- Due Dates: Hold an in depth listing of all of your invoice due dates in December. Set reminders in your telephone or calendar to make sure well timed funds and keep away from late charges.

- Autopay: Contemplate organising autopay for recurring payments via your Netspend account to simplify the fee course of and keep away from missed funds.

- Finances Allocation: Allocate ample funds in your Netspend account to cowl all of your invoice funds. Keep away from overspending in different areas to make sure you have sufficient for important bills.

4. Present Giving:

- Present Card Purchases: Netspend playing cards can be utilized to buy reward playing cards, which is usually a handy and considerate reward choice.

- Direct Deposits: For those who’re sending cash to household or mates, think about using Netspend’s direct deposit or peer-to-peer switch choices.

- Monitoring Bills: Hold a file of all reward purchases to remain inside your funds and keep away from overspending.

5. 12 months-Finish Monetary Overview:

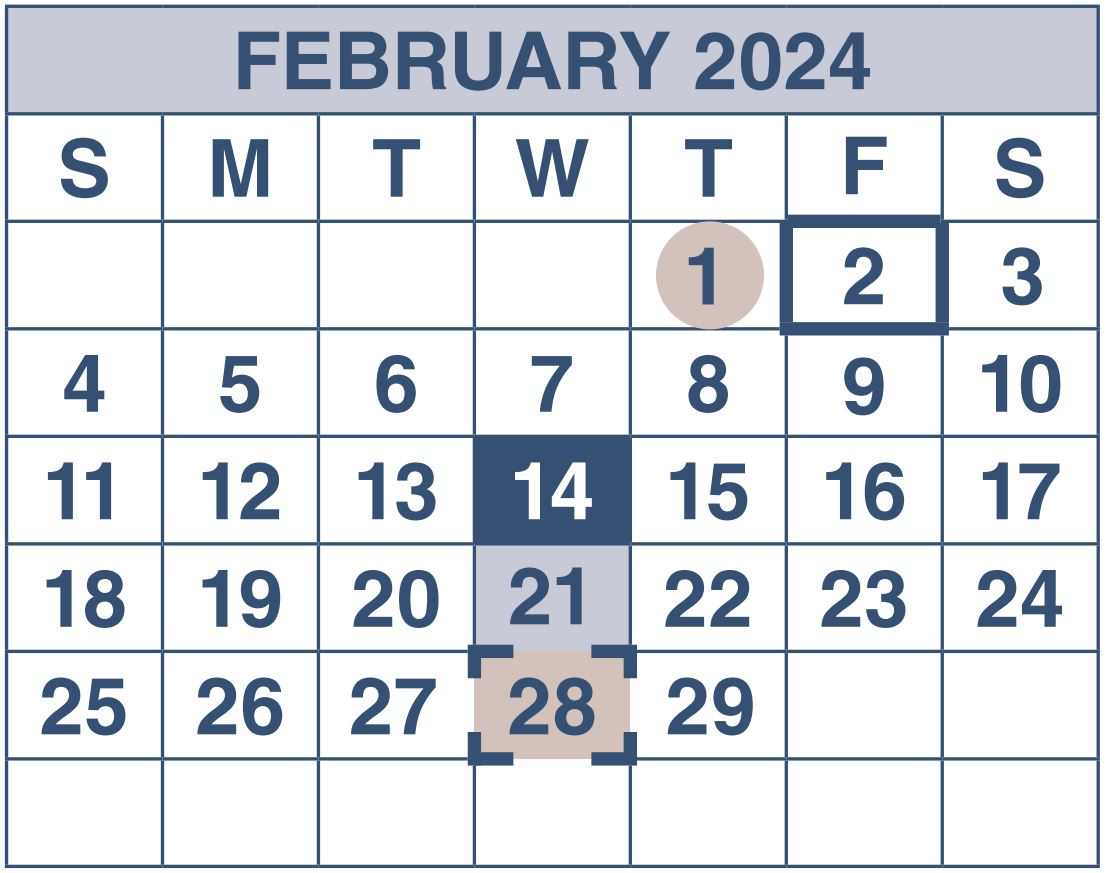

- Reconciliation: Earlier than the tip of the 12 months, reconcile your Netspend account statements along with your private data to make sure accuracy and establish any discrepancies.

- Tax Implications: Overview your spending all year long to arrange for tax season. Hold data of all earnings and bills associated to your Netspend account.

- Future Planning: Use your December monetary expertise to tell your budgeting and spending plans for the approaching 12 months.

Proactive Methods for December 2025:

- Early Budgeting: Begin budgeting for December properly prematurely, ideally in November and even earlier. This lets you unfold out your bills and keep away from last-minute monetary stress.

- Common Account Monitoring: Test your Netspend account steadiness repeatedly, ideally every day or not less than weekly, to trace your spending and guarantee you have got ample funds.

- Emergency Fund: Having a small emergency fund in your Netspend account can present a security web in case of sudden bills.

- Using Netspend Options: Familiarize your self with all of the options of your Netspend account, together with cellular app notifications, budgeting instruments, and buyer assist choices.

- Contacting Buyer Help: Do not hesitate to contact Netspend buyer assist if in case you have any questions or encounter any issues along with your account.

Potential Challenges & Options:

- Overspending: The vacation season typically results in overspending. Sticking to a strict funds and utilizing the Netspend app to trace your spending can assist stop this.

- Inadequate Funds: Plan your spending rigorously to keep away from working out of funds. Contemplate organising automated transfers from one other account to make sure you at all times manage to pay for.

- Charges: Concentrate on potential Netspend charges, reminiscent of ATM withdrawal charges or overdraft charges, and plan accordingly. Use in-network ATMs and keep away from overspending to reduce these prices.

- Safety Dangers: Be vigilant about on-line safety when utilizing your Netspend card for on-line purchases. Use sturdy passwords, safe web sites, and keep away from public Wi-Fi for delicate transactions.

Conclusion:

Successfully managing your Netspend account in December 2025 requires proactive planning and cautious budgeting. By understanding your anticipated earnings and bills, using the Netspend app’s options, and staying conscious of potential challenges, you possibly can navigate the vacation season financially responsibly and luxuriate in a stress-free festive interval. Keep in mind that this text gives a common framework. At all times confer with Netspend’s official web site and phrases of service for essentially the most up-to-date info on charges, options, and account administration. Proactive planning is vital to a profitable and financially sound December 2025.

Closure

Thus, we hope this text has supplied worthwhile insights into Navigating the Netspend Calendar for December 2025: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!